Understanding your Explanation of Benefits (EOB) is crucial for effectively managing your healthcare expenses and ensuring you’re not overcharged for medical services. EOBs provide a detailed breakdown of the costs associated with your medical care, including what your insurance covers and what you may owe out-of-pocket. This comprehensive blog post aims to demystify EOBs, helping you navigate the complex world of medical billing with confidence.

What is an Explanation of Benefits (EOB)?

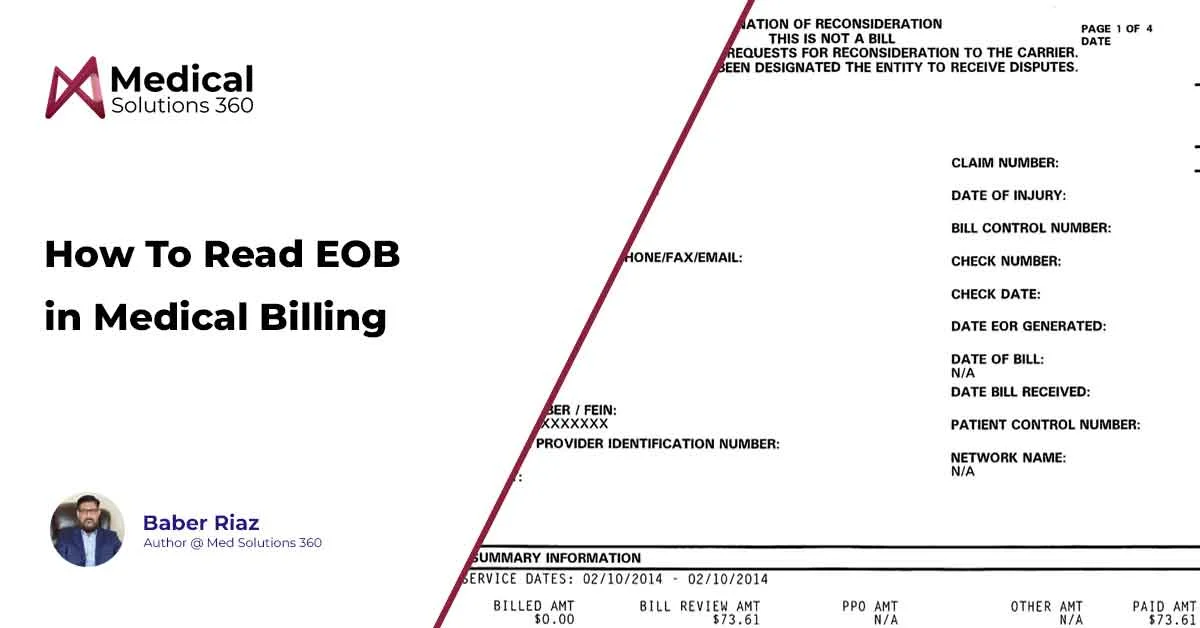

An Explanation of Benefits (EOB) is a statement provided by your health insurance company that outlines the medical services you received, the costs associated with those services, and how much your insurance plan covers. It is essential to understand that an EOB is not a bill. Instead, it is a document that helps you understand your medical expenses and any potential out-of-pocket costs you may be responsible for paying.

EOBs are typically sent by your insurance company after they have processed a claim submitted by your healthcare provider. The EOB will arrive in the mail or be available online through your insurance company’s portal. You can expect to receive an EOB anytime you receive medical services, whether it’s a routine check-up, a specialist visit, or a surgical procedure.

Purpose of an EOB

The primary purpose of an EOB is to provide a detailed breakdown of your medical services and costs. It will list the date of service, the healthcare provider, and a description of the services rendered. The EOB will also show the amount billed by your provider, the amount your insurance plan has agreed to pay, and any discounts or adjustments applied to the total cost.

Moreover, the EOB will explain your insurance coverage for the specified medical services. It will outline your plan’s deductible, copayment, and coinsurance amounts, as well as any services that are not covered under your insurance policy. This information helps you understand how your insurance benefits are being applied to your medical expenses.

Another crucial aspect of an EOB is the clarification of patient responsibility. After your insurance company has paid its portion, the EOB will display the remaining balance that you, the patient, are responsible for paying. This amount may include deductibles, copayments, coinsurance, or charges for services not covered by your insurance plan. By reviewing your EOB carefully, you can better understand your financial obligations and plan accordingly.

Key Components of an EOB

An EOB is divided into several key sections, each providing essential information about your medical services and costs. Understanding these components is crucial for interpreting your EOB correctly. The main sections include patient information, service details, billing information, insurance responsibility, and patient responsibility. Let’s take a closer look at each of these components.

Patient Information

The patient information section of your EOB contains personal details such as your name, address, and insurance policy number. It may also include your member ID and group number, which are essential for identifying your specific insurance plan. This section ensures that the EOB pertains to your medical services and insurance coverage.

Service Details

The service details section lists the medical services you received, including the date of service, the healthcare provider’s name, and a brief description of each service. This information helps you track the specific treatments or procedures you underwent and ensures that the EOB aligns with your medical history.

Billing Information

In the billing information section, you’ll find the amount billed by your healthcare provider for each service. This is the total cost of the service before any insurance adjustments or discounts are applied. Additionally, this section will show the allowed amount, which is the maximum amount your insurance plan has agreed to pay for the service. Any adjustments or discounts applied to the billed amount will also be listed here.

Insurance Responsibility

The insurance responsibility section outlines the portion of the medical costs that your insurance company will cover. It includes the amount paid by your insurance plan for each service, as well as an explanation of your coverage benefits. This section will also detail any deductibles, copayments, or coinsurance amounts that apply to your specific insurance plan.

Patient Responsibility

After your insurance company has paid its portion, the remaining balance becomes your responsibility as the patient. The patient responsibility section of your EOB will clearly state the amount you owe for the medical services received. This may include any deductibles, copayments, coinsurance, or charges for services not covered by your insurance plan. An explanation of your liability will be provided, helping you understand why you are responsible for these costs.

How to Read and Understand Your EOB

Reading and understanding your EOB is essential for managing your healthcare expenses effectively. To review your EOB, start by verifying your personal information and ensuring that the services listed match your medical records. Then, focus on the billing information, insurance responsibility, and patient responsibility sections to understand the costs associated with your care.

When reviewing your EOB, identify the important information, such as the total amount billed, the amount covered by your insurance, and the remaining balance you owe. Compare this information with any medical bills you receive from your healthcare provider to ensure accuracy and consistency. If you notice any discrepancies or have questions about your EOB, contact your insurance company or healthcare provider for clarification.

Common EOB Terms and Definitions

EOBs often contain industry-specific terms and jargon that can be confusing for patients. To help you better understand your EOB, familiarize yourself with common terms and their definitions. Some frequently used terms include:

– Deductible: The amount you pay for covered services before your insurance plan starts to pay.

– Copayment: A fixed amount you pay for a covered service, usually at the time of service.

– Coinsurance: The percentage of costs you pay for a covered service after meeting your deductible.

– Out-of-pocket maximum: The most you’ll pay for covered services in a plan year before your insurance covers 100% of the costs.

Conclusion

In summary, understanding your Explanation of Benefits (EOB) is crucial for managing your healthcare expenses effectively. By familiarizing yourself with the key components of an EOB and actively reviewing them, you can gain clarity on your medical costs, insurance coverage, and financial responsibilities. If you need assistance with medical billing or navigating EOBs, consider reaching out to medsolutions360.com, a trusted provider of expert medical billing services. Remember, staying informed and proactive is essential for making the most of your insurance benefits and maintaining control over your healthcare finances.